Short-term goals: For those eyeing a dream vacation or a home revamp, Yenmo offers a seamless solution. By leveraging mutual funds, users access instant liquidity at competitive rates without compromising long-term investments.

Long-term goals: Planning for significant milestones like a child’s education, retirement, or buying a home requires careful financial management. Yenmo steps in as the ideal partner, allowing users to leverage their mutual funds to secure liquidity. More importantly, Yenmo’s interest rate of 10.5% is much less than a loan to these ends.

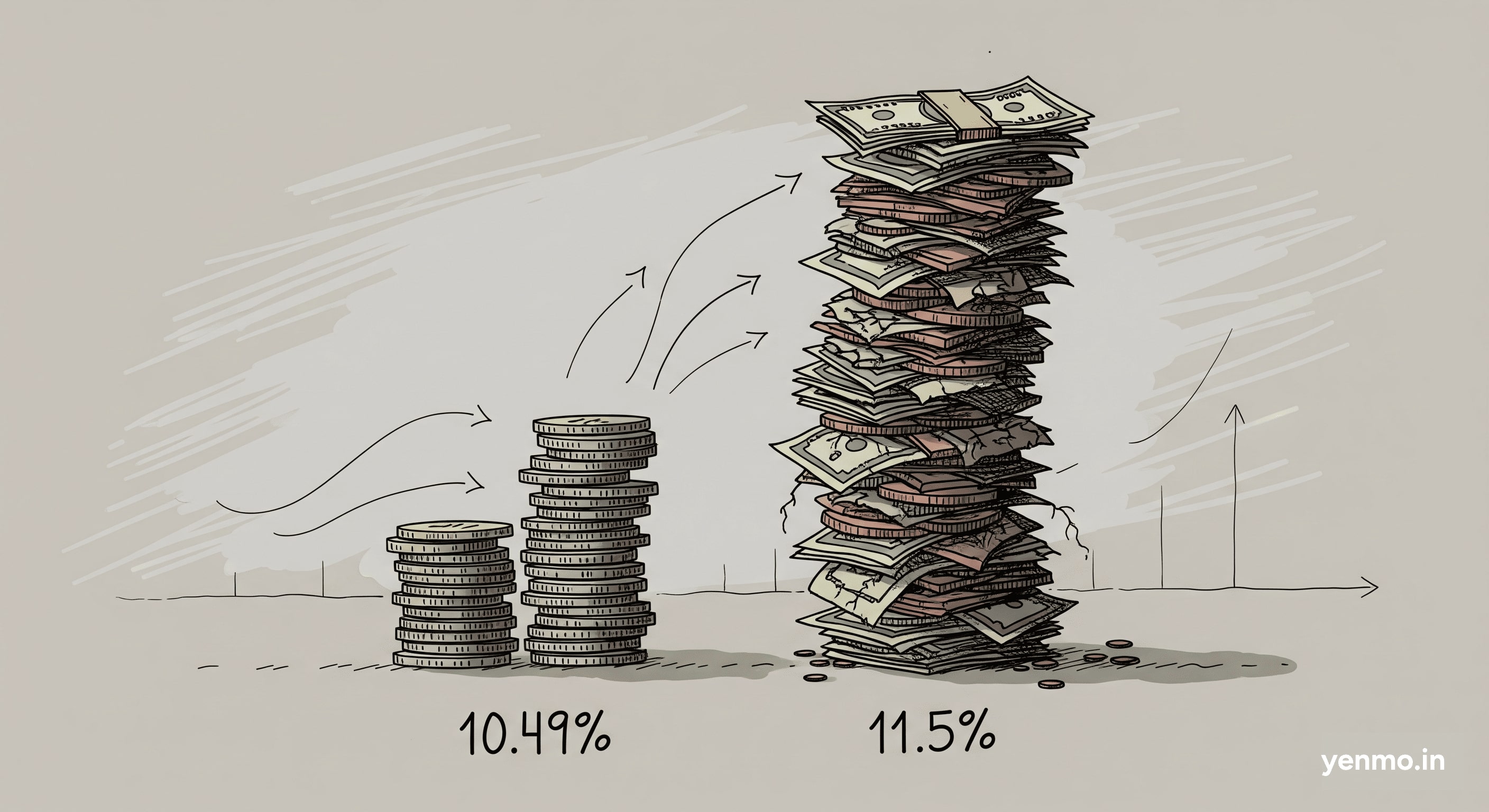

Arbitrage opportunities: Yenmo gives you the option of getting liquidity without breaking your investments. This opens up opportunities for arbitrage gains. You can use the funds to get into P2P lending, or timing the market to swing trade.

Emergency funds: You never know when you might need urgent liquidity. This is where Yenmo is your best option. When you pledge your investments, you get instant cash in your account in less than 5 minutes. The best part is that you only need to pay interest on the amount you withdraw. Be ready for a rainy day with Yenmo.

Way ahead Backed by YCombinator, one of the largest venture capital funds and accelerators in the US, Yenmo is proud to lead innovation. With $500K in funding and recognition, as the only Indian company selected by YC in the current batch that is building for Indian consumers like you, Yenmo is committed to revolutionising lending in India.

With all of this, we are just getting started, with plans to launch new products such as loans against stocks, insurance, digital gold, and even land. Partnering with some of India’s largest Banks & NBFCs, Yenmo aims to make lending against mutual funds accessible to more customers.