The world of lenders and credit facilities is cluttered. So, why are we throwing our hat in here as well?

Well, because Yenmo isn’t your typical lending platform. We’re here to promote healthy financial behaviour, where taking a loan actually increases your net worth. Here’s a rundown of everything you need to know about Yenmo.

What is Yenmo?

Yenmo is a facility that gives you a credit limit against your Mutual Funds at a low rate of 10.5%. Instead of selling your mutual funds, you can leverage them to access liquidity while your investments continue to grow. It’s a win-win! It is an alternative to loans with sky-high interest rates, long wait lists, and a picky credit disbursement process.

With Yenmo, you can fetch your mutual fund investments across multiple platforms & avail credit limit against it completely digitally on our app. You get to use this with flexibility i.e., you only have to pay interest when you withdraw from this pool (your credit limit). Yenmo’s account acts as a safety net for when you need them.

Yes! Yenmo’s Loan Against Mutual Fund (LAMF) tool operates under RBI regulations. Like any other Loan, this LAMF has to adhere to all regulatory processes conducted by RBI.

What are the benefits of Yenmo?

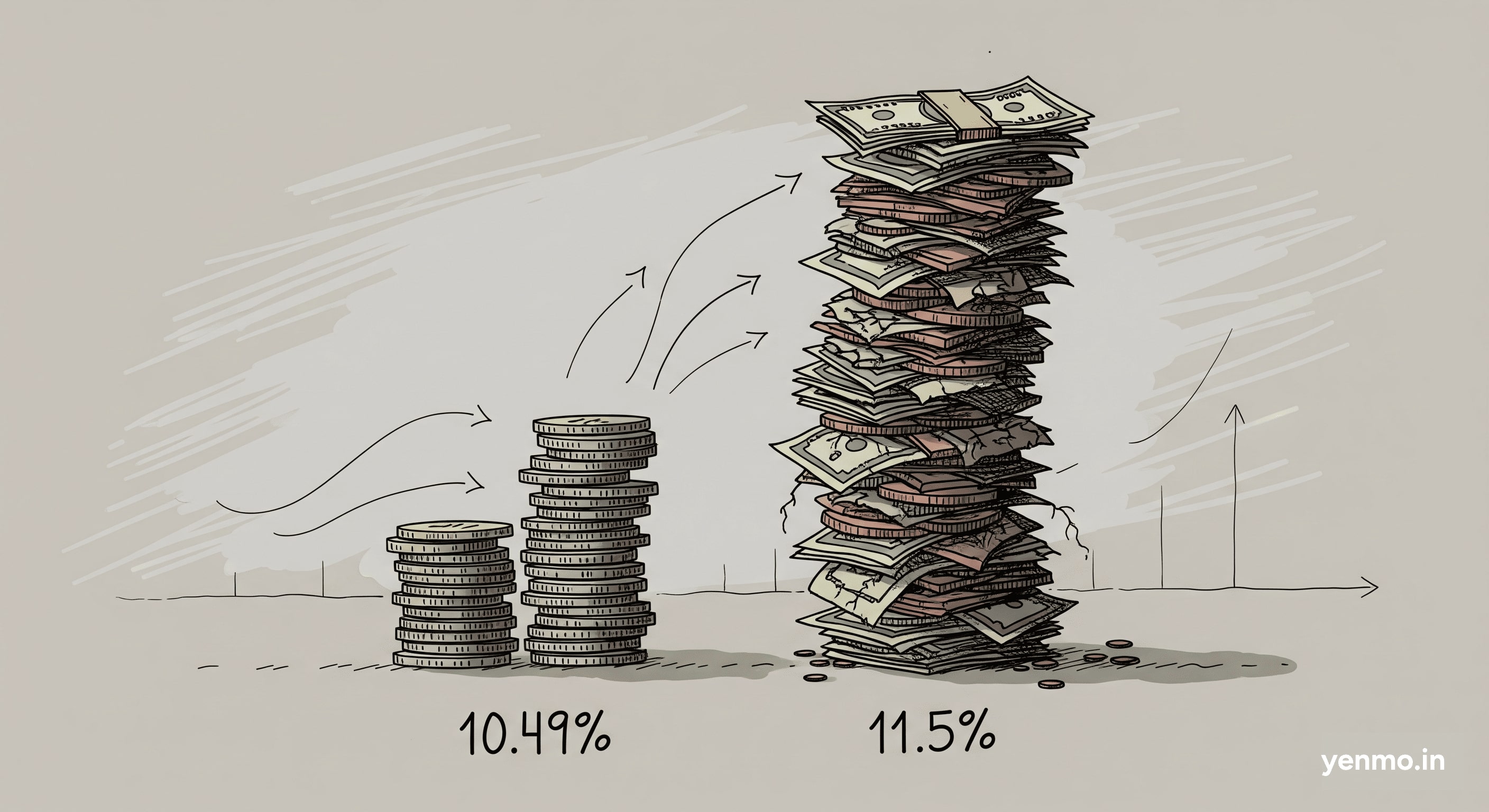

Interest Rate:

With a low interest rate of 10.5%, our loans against mutual funds offer a compelling alternative to other loan products such as personal loans and credit cards and many other high interest loans out in the market. This is while you retain ownership of your funds and continue to reap the benefits of growth and dividends. Since taking a loan on Yenmo is a fully digital process you access your funds within minutes.

Mutual Fund Growth:

Mutual Funds give you 15% returns p.a (Nifty50’s last 5 year CAGR). Breaking Mutual Fund investments means loss of this growth and its positive compounding effects. With Yenmo, you get a loan of 10.5% interest, without breaking your investments. You make 4.5% additional return (15% – 10.5%) even after paying our interest. This is especially helpful in cases where you have dedicated SIPs. You can prevent them from getting derailed in case of sudden liquidity needs.

Tax benefits:

When you redeem your mutual funds, it triggers capital gains tax for equity funds and income tax for debt funds, based on your tax bracket. Short-term capital gains tax for equity funds is 15%, while long-term gains are taxed at 10%. Debt fund redemptions are taxed according to your highest tax bracket. Using Yenmo is a way of getting the liquidity you need while not having to pay these taxes.

Flexibility:

Yenmo offers an overdraft facility where you can pledge your investments to get instant cash credited to your account.

- Interest is only applied on the amount withdrawn, not the total, thus reducing interest burdens.

- You can opt to pay only interest each month without worrying about hefty EMIs which burn a hole in your wallet.

- You can pay back the principal anytime during the loan tenure without any prepayment charges.

Safe:

Your Mutual Funds are still yours when you take a loan against it. It keeps growing. Yenmo doesn’t tamper with it and doesn’t have access to it. CAMS and KFin hold the Mutual Fund data of all investors in India. They are regulated by SEBI and help manage mutual funds data and investor services. Even when you take a loan from Yenmo, only CAMS and KFin have your mutual funds units, not us. You are essentially just pledging your Mutual Funds as collateral, but are still the owner of your funds. All the benefits like growth and dividends are still accumulated by you. When you pay off the loan, this collateral is released and you’ve reaped the benefits of the loan.

What are the use cases of Yenmo?

Short-term goals:

For those eyeing a dream vacation or a home revamp, Yenmo offers a seamless solution. By leveraging mutual funds, users access instant liquidity at competitive rates without compromising long-term investments.

Long-term goals:

Planning for significant milestones like a child’s education, retirement, or buying a home requires careful financial management. Yenmo steps in as the ideal partner, allowing users to leverage their mutual funds to secure liquidity. More importantly, Yenmo’s interest rate of 10.5% is much less than a loan to these ends.

Arbitrage opportunities:

Yenmo gives you the option of getting liquidity without breaking your investments. This opens up opportunities for arbitrage gains. You can use the funds to get into P2P lending, or timing the market to swing trade.

Emergency funds:

You never know when you might need urgent liquidity. This is where Yenmo is your best option. When you pledge your investments, you get instant cash in your account in less than 5 minutes. The best part is that you only need to pay interest on the amount you withdraw. Be ready for a rainy day with Yenmo.

Way ahead

Backed by YCombinator, one of the largest venture capital funds and accelerators in the US, Yenmo is proud to lead innovation. With $500K in funding and recognition, as the only Indian company selected by YC in the current batch that is building for Indian consumers like you, Yenmo is committed to revolutionising lending in India.

With all of this, we are just getting started, with plans to launch new products such as loans against stocks, insurance, digital gold, and even land. Partnering with some of India’s largest Banks & NBFCs, Yenmo aims to make lending against mutual funds accessible to more customers.