It’s essential to recognize that responsibly leveraging a loan can actually be a wise decision, paving the way for achieving your financial goals efficiently.

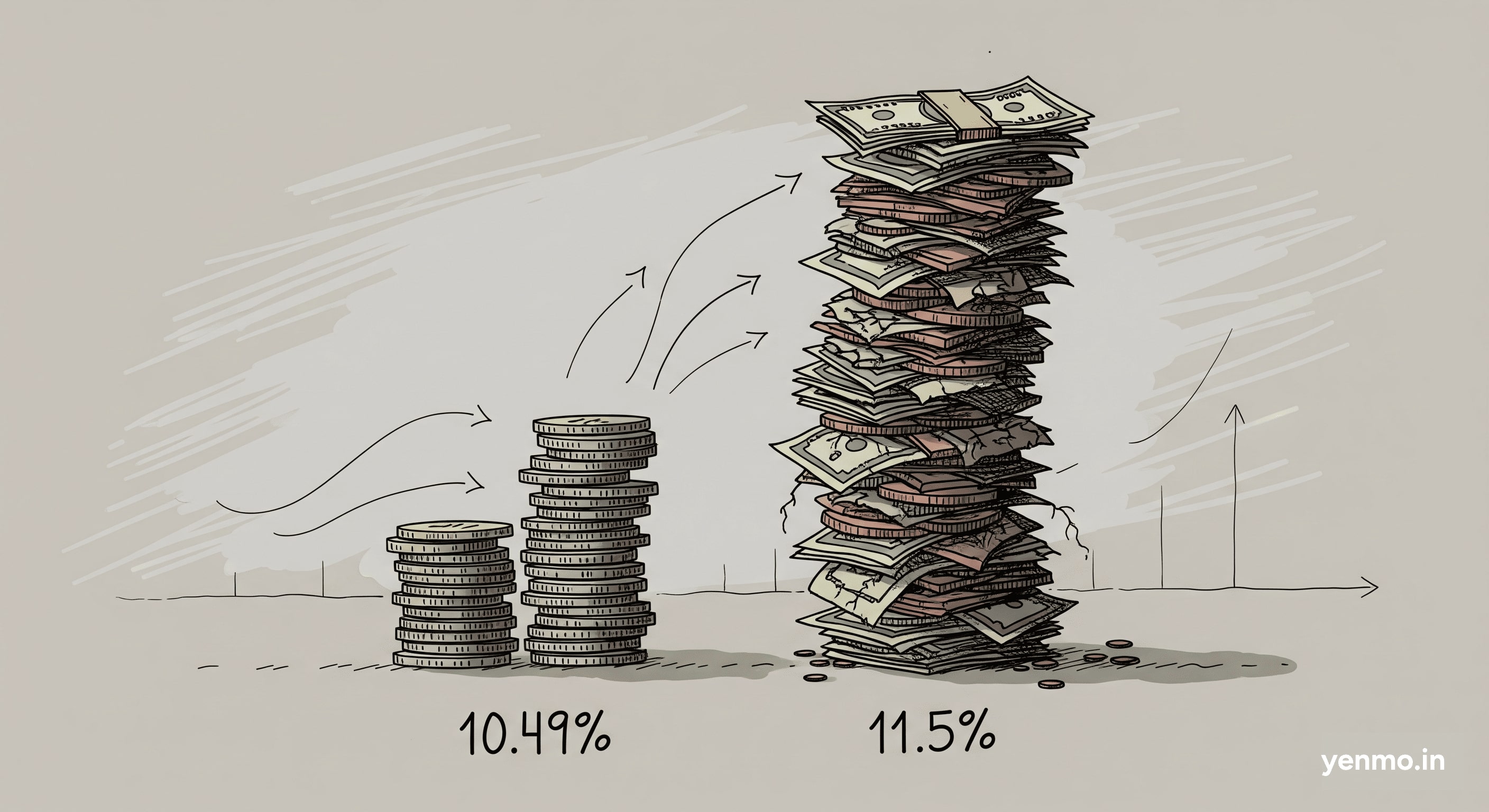

Take, for instance, Yenmo’s enticing offer of a 10.5% Loan against Mutual Finds (LAMF). Rather than viewing it sceptically, consider the numerous benefits and opportunities it can unlock for you. Let’s delve into why embracing this option could be a positive step towards realising your aspirations.

It’s essential to recognize that responsibly leveraging a loan can actually be a wise decision, paving the way for achieving your financial goals efficiently.

Is Yenmo safe?

Yes! Yenmo’s Loan Against Mutual Fund (LAMF) tool operates under RBI regulations. Like any other Loan, this LAMF has to adhere to all regulatory processes conducted by RBI.

What are RBIs regulations for Loans Against Mutual Funds? And how we offer you a enhanced experience;

What are RBIs regulations for Loans Against Mutual Funds? And how we offer you a enhanced experience;

- LTV Ratio: RBI recommends a Loan to Value (LTV) ratio of 0% to 90% of the mutual fund’s Net Asset Value (NAV) for loans depending on various risk criterias.

- Eligibility: Over 5000+ mutual funds are eligible for loan against mutual funds with Yenmo, These include your equity funds, debt funds & index funds, flexi-cap funds, large cap funds, midcap funds, small cap funds. We even provide loan against your ELSS mutual funds if they are out of the lock-in period.

- Lenders: Only scheduled commercial banks and RBI-registered NBFCs can offer loans against mutual funds. We have tied-up with some of the largest & most reputable lenders to offer you the best loan terms.

- Documentation: Proper loan agreements, valuation reports, and disclosures must be maintained by lenders. We provide a seamless digital journey to complete the loan application in our app with just a few clicks.

- Interest Rates: RBI doesn’t specify rates but mandates transparent disclosure of interest, charges, and fees. You can view all the charges involved very clearly on our app.

- Risk Disclosure: Lenders must disclose the risks associated with the loan.

- Non-Discrimination: Fair lending practices must be followed without discrimination based on race, religion, gender, or caste.

Now that you have a clearer idea of how Yenmo’s LAMF operates, let’s address another common doubt you might have about this.

Will my Mutual Funds be safe with Yenmo?

Absolutely!

As a matter of fact, Yenmo will NOT be holding in your pledged Mutual Funds.

CAMS and KFin are regulated Indian entities that hold Mutual Fund data for all investors in India. These entities help manage Mutual Funds and Investor Services. So when you pledge a loan against a Mutual Fund with Yenmo, only CAMS and KFin have access to your funds.

So how does a LAMF with Yenmo actually work?

It’s simple. Your Mutual Funds are essentially collateral that you pledge to take this Loan. Compared to other Loans where you might pledge land or property as collateral, the pledging is very simple for you as you pledge your Mutual Funds with us completely digitally.

Throughout the tenure of the Loan, you will continue to be the owner of your Mutual Funds. Yenmo does not hold the authority to own your Mutual Funds. You will continue to reap the compounding benefits of your Mutual Funds, ensuring that your long-term goals are not disrupted.

What happens once the tenure is over?

Well, once you’ve repaid your Loan and the Loan tenure is completed, your pledged Mutual Funds are released. You walk out with your compounded Funds and can then decide what you would want to do with this corpus.

Sounds simple right?

Yenmo’s 10.5% LAMF comes with flexible options to make this Loan journey easier for you. You can choose to withdraw the Loan amount as you will, pay only the interest each month, and pay the principal amount when you have the cash without any additional charges or penalty.

What do you need to get started?

Well, you just need the Yenmo app. Yenmo does not put you through strict credit checks, nor does it require you to spend long hours on paperwork. The LAMF tool is simple, quick, and super accessible.

Want to know more? Download the Yenmo App today!