These days, people are always searching for more intelligent ways to manage their funds in the ever-changing financial world we operate in. Among these new trends is using your investments — especially mutual funds and stocks) as collateral. This gives businesses a realistic alternative to traditional loans, which can give them flexibility in this area without hindering long-term financial aspirations. As more people realize the benefits of leveraging their investments for short-term needs, borrowing against investments is poised to become a cornerstone of personal finance.

Borrowing against investments is using one’s investments as collateral to make a loan. Here, an individual can put up their equities, say bonds or mutual funds, to get a loan. Thus, instead of applying for a regular loan, which may involve credit checks or personal guarantees, this kind of loan has insurance based on the worth of the individual’s investments. Even though access to funds is provided, the borrower still owns their assets.

This method is very useful in cases where the person who needs it, is not ready to sell his investments, as that comes with the possibility of losses or taxation. Such investors may not need to sell their assets, which may affect their long-term goals. Rather, they deploy their resources in ways that prevent them from selling their investment portfolios and benefiting from market appreciation.

- Pros of Borrowing Against Investments

Borrowing against investments offers multiple benefits over traditional means of borrowing, which is one reason it is growing in popularity.

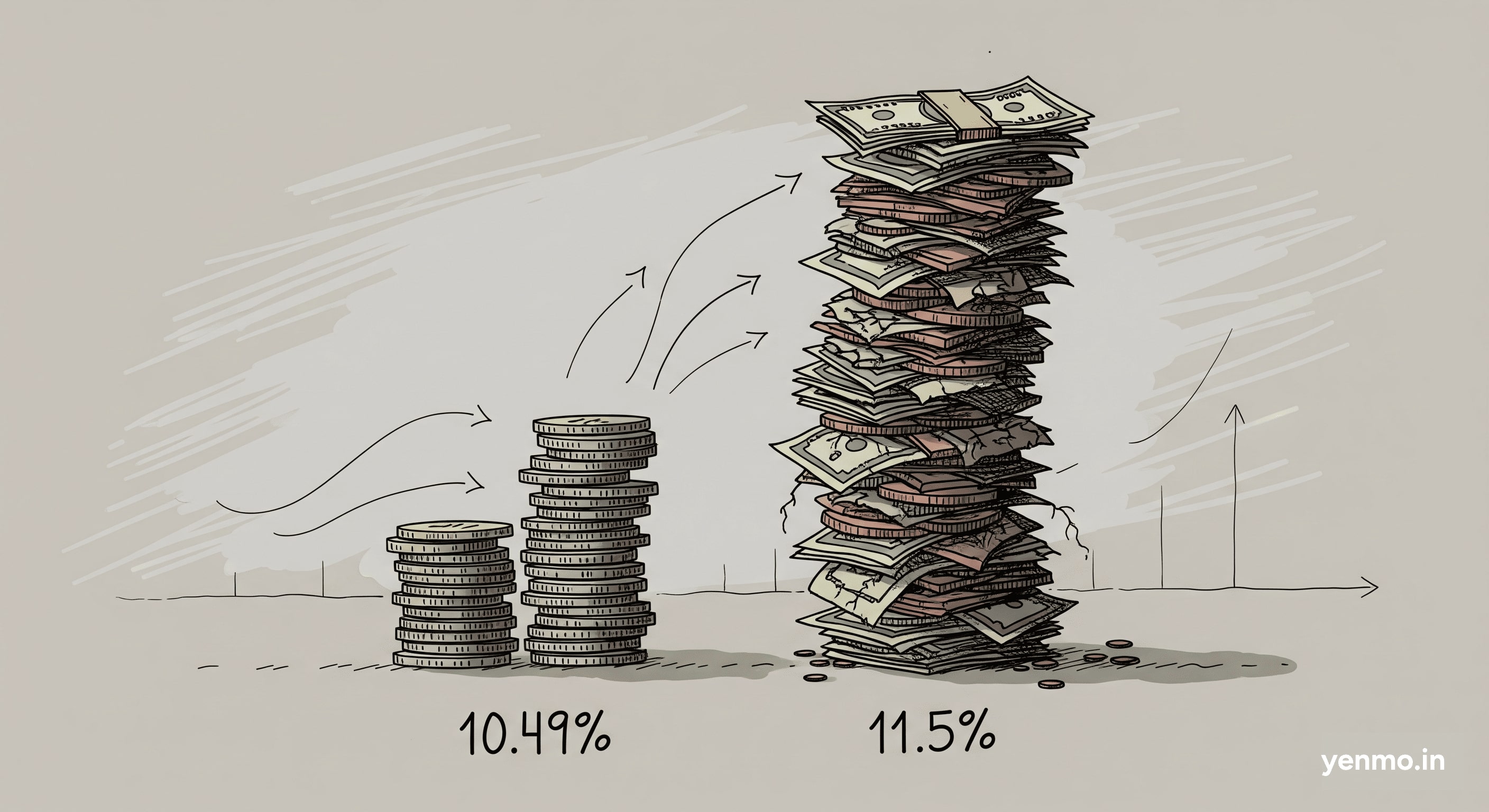

- Less Interest Charges: The interest rates on investment-backed loans are normally much lower than those on unsecured personal loans or credit card debt. Since the borrower is required to put up collateral, the lender’s risk of writing a second lien loan has been mitigated.

- Quick Access to Funds: Borrowers can access the money, often within hours or a single business day; with other traditional loans, it takes weeks.

- No Credit Impact: While investments back the loan, a credit check typically isn’t needed for this reason (and, therefore, won’t affect your credit score).

- Continued Growth of Investments: Loans obtained for investment purposes are secured by equity, which in turn increases, grows, and produces returns. This serves a dual purpose, as the borrowers are able to finance their current needs without losing prospects for future growth.

- Calculating the Loan Amount

When planning to borrow a percentage against one’s investments, it is necessary to understand how much you can borrow. This is why a loan against mutual fund calculator is so important. Most of these calculators return an estimate of the loan amount that is possible according to the investor’s current mutual fund holdings.

The calculator depends on the type of mutual fund held, the number of units held, and the current NAV of each mutual fund unit. With these inputs, the calculator gives the approximate amount of the loan, its interest, and payback duration. This, therefore, enables the customers to borrow wisely, that is, only the exact amount they need and can repay.

- The Crossroad of Mutual Funds and Taxation

One of the most pertinent aspects when dealing with mutual funds in a loan against collateral is tax consequences. It is vital to appreciate the interaction between the two so as to be prepared for such costs that may not be included in the initial plan. No tax would be triggered on taking a mortgage loan against the mutual funds; however, there will be a capital gains tax on selling the funds to pay off the loan.

Typically, capital gains taxation is required when mutual funds are divested for a profit. The longer the investor owns the mutual fund shares, the lower the tax rates are applied. Investors need to understand such taxation aspects well, and then loan and investment schemes need to be planned. With the right knowledge of the interconnection of mutual funds and taxes, one can manage and even better recover tax liabilities.

- Leveraging a Loan on Mutual Funds for Financial Flexibility

Getting a loan against mutual funds is one of the best methods to achieve financial freedom. It enables investors to meet their urgent monetary requirements while ensuring that their long-term objectives are unaffected. Hence, if an investor encounters an unforeseen cost or constraints concerning cash flow, they can take the loan on mutual funds that they own. This method is far better than phasing out investments, which will attract capital gains taxes and eventually cause them to lose much more in future returns.

Furthermore, the fact that the borrowers can continue earning returns on the pledged investments while accessing liquidity is a win-win situation for them. This twofold advantage benefits those people who need resources in the short term yet wish to grow their funds, opting to borrow against mutual funds in the long run.

- The Future of Personal Finance: A Shift Towards Investment-Backed Loans

As with any trade, the more refined the market becomes, the more there is a need for new ways of borrowing. This has led to the emergence of borrowing against investments, which is a much more effective way of handling personal finances.

Several factors contribute to this growing trend-

- Economic Uncertainty: Under such circumstances, the more conventional types of money being lent may not look very appealing. That is why borrowing against investments offers a secure, low-cost alternative that appeals to cautious investors.

- Regulatory Support: As regulators continue to encourage financial developments, the framework for borrowing against investments will be upgraded, thereby expanding the audience even further.

To sum up, borrowing against investment assets is now gaining acceptance as a personal finance of the future. This is so as more people come to understand how borrowing against investments assists in meeting their immediate needs in the short term. Hence, it is expected that in the years to come, borrowing against investments will become a key part of most people’s financial management strategies. One could achieve both objectives of preserving and increasing the investment assets while also being able to access the required funds.