RBI’s 50 bps Repo-Rate Cut: What It Means for Your Borrowing Cost in 2025

On 6 June 2025, the Reserve Bank of India (RBI) delivered a larger-than-expected 50-basis-point (0.50 %) cut to its key repo rate, bringing it down to 5.5 %. The central bank also trimmed the cash-reserve ratio (CRR) by 100 bps to boost liquidity.

This “jumbo” move is the steepest single cut in five years and follows a 25 bps reduction in April, signalling the RBI’s intent to support growth as inflation softens. Below, we decode how the policy change flows through to real-world lending rates—including loans against mutual funds (LAMF), home loans, and other credit products.

Quick Refresher: What Is the Repo Rate?

The repo rate is the interest the RBI charges commercial banks when it lends them short-term funds. Cutting the repo rate lowers banks’ cost of funds, encouraging them to reduce lending rates for consumers and businesses—a process called monetary transmission.

How Fast Will Borrowing Rates Fall?

Historically, secured loans—such as gold loans or loans against securities—reflect repo-rate changes faster than unsecured personal loans. The RBI has already asked banks to pass on the cut promptly, citing healthy liquidity conditions.

| Loan Type | Typical Rate (May 2025) | Expected New Band* |

|---|---|---|

| Home Loan (Floating) | 8.35 % – 9.05 % | 7.85 % – 8.55 % |

| Top NBFC Personal Loan | 12 % – 24 % | 11.5 % – 23 % |

| Loan Against Mutual Funds (Yenmo) | 10.5 % | 10.35% – 10.40% |

*Estimates based on past transmission lags.

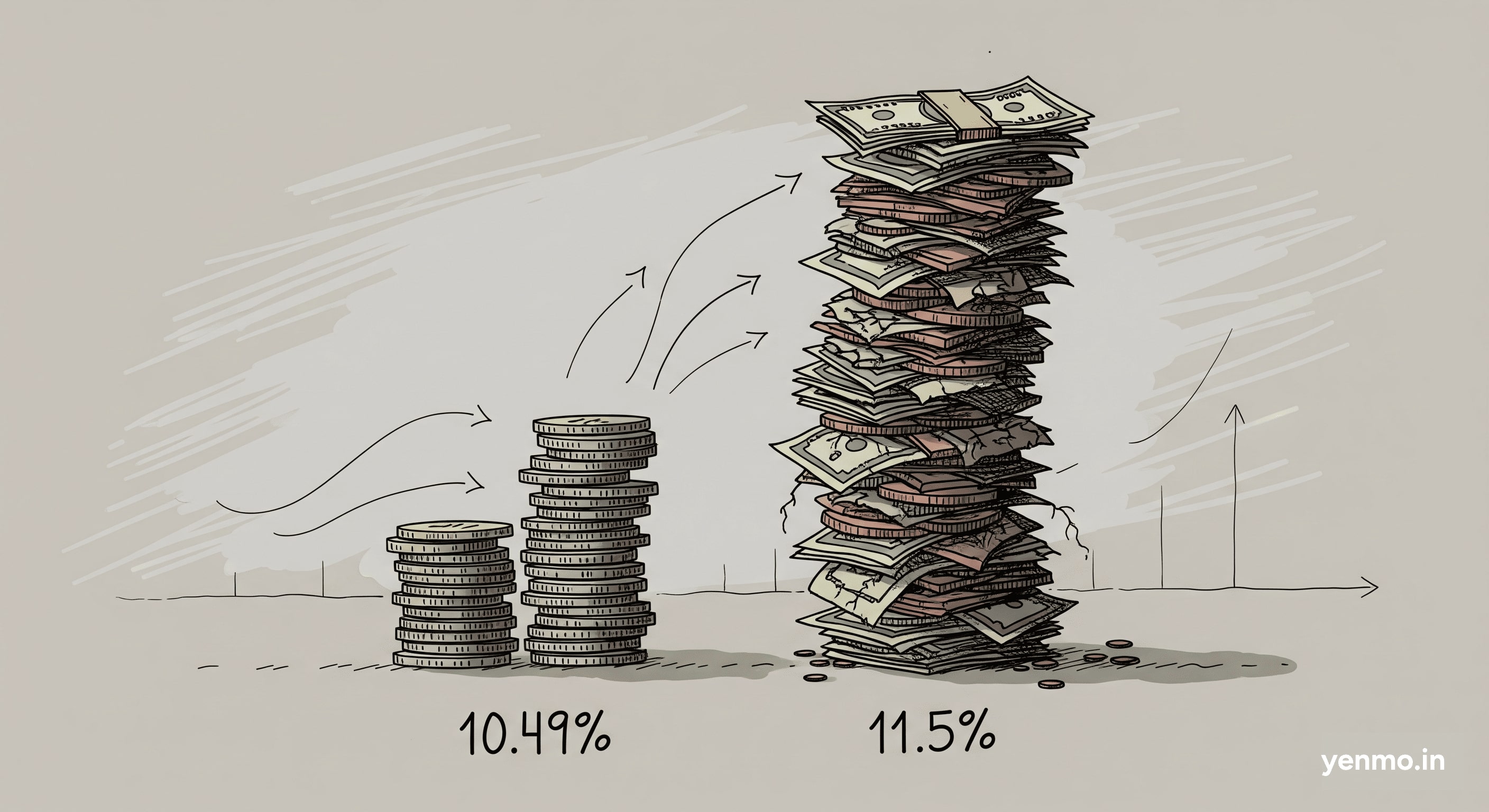

Why Loans Against Mutual Funds Stay a Step Ahead

Because LAMF is backed by liquid collateral—your mutual-fund units—banks and fintech lenders face lower credit risk. That’s why the average LAMF rate already sits 150–300 bps below most unsecured personal loans. With the repo cut, lenders like Yenmo have additional room to maintain low pricing.

- Flat 10.5 % p.a. rate, unaffected by short-term repo swings

- No foreclosure or part-payment fees

- Interest-only monthly outgo; repay principal anytime

RBI’s Record Bond Purchases: More Liquidity Ahead

Alongside the rate cut, the RBI’s holdings of government securities climbed to an all-time high of ₹14.9 trn by March-end, following aggressive open-market operations worth ₹2.45 trn in Q4 FY 2024-25.:contentReference[oaicite:2]{index=2} Larger bond holdings keep yields lower and inject liquidity—another positive for borrowers.

Action Plan for Borrowers in 2025

- Wait for your bank to announce a floating-rate reset; schedule a call if they delay.

- Refinance high-cost personal loans into lower-rate secured options where possible.

- Need quick liquidity? Use your existing MF portfolio as collateral via a Loan Against Mutual Funds and avoid fresh high-cost credit.

Bottom Line

The RBI’s surprise 50-bps cut has set the stage for lower borrowing costs through 2025. While personal and home-loan EMIs should ease gradually, secured products like Yenmo’s LAMF already deliver savings—without forcing you to liquidate investments.

Check your eligibility in minutes and turn your mutual-fund units into low-cost liquidity today.